By registering and using Lonestar Cell MTN Mobile Money Inc. Service the Account Holder agrees to be bound by these terms and conditions as amended from time to time. The Account Holder also confirms he/she is: (i) a LCMMMI’s. subscriber; (ii) 18 years or over (provided that an individual under 18 years may register and use the Service if they register in the presence of and with the authority of his/her legal guardian who will verify each use of the Service by the minor and agrees to so do by signing these terms and conditions.

2. DEFINITIONS

"Account" means the Mobile Money transactional bank account which is accessed primarily through the Account Holder’s cell Phone.

"Account Holder" means a Lonestar Cell MTN Mobile Money Inc. subscriber in whose name the Mobile Money account is registered and who is a Lonestar Cell MTN subscriber.

"LCMMMI.” means Lonestar Cell MTN Mobile Money Inc.

"Phone" means a GSM cell phone, handset or terminal connected via a GSM radio link to the Lonestar Telecommunications network.

"Debit" means the movement of funds out of the Account.

“force majeure” means any circumstances beyond LCMMMI’s control, including without limitation, an act of God, of public enemy, fire, explosion, earthquake, perils of the sea, flood, storm or other adverse weather conditions, war declared or undeclared, civil war, revolution, civil commotion or other civil strife, riot, blockade, embargo, sanctions, epidemics, act of any government or other authority, compliance with government orders, demands or regulations, or any act or omission on the part of a third party service providers

"GSM" means the global system for mobile communications as per European Technical Standards Institute's list of specifications.

"Agent" means an entity registered by LCMMMI to provide and carry out Mobile Money Services.

"Mobile Money" means the financial services product offered by Lonestar Cell MTN Mobile Money Inc. being a transactional banking account operated through an Account Holder’s Phone.

“Lonestar” means Lonestar Communications Corporation

"POS" means a point of sale used for Mobile Money transactions.

"PIN" means personal identification number being the secret code the Account Holder will choose upon registration for Mobile Money Services.

"Services" means the services provided by Lonestar relating to your cell Phone to enable you to use Mobile Money.

"SMS" means a short message service consisting of a text message.

3. MOBILE MONEY SERVICE

3.1 Mobile Money enables the Account Holder to transfer, deposit and withdraw money (and such additional activities and service features as may from time to time be offered by LCMMMI) utilizing their Phone or any Agent.

3.2. As a combined telecommunications and financial service, Mobile Money is subject to both telecommunications and financial regulations and may on occasion have to comply with regulatory requirements which may directly or indirectly affect Account Holders.

4. APPLICATION FOR MOBILE MONEY ACCOUNT

4.1. Any Lonestar subscriber may apply to register for the Mobile Money service provided they have an active SIM. The applicant will be required to provide information for registration to use the Mobile Money service. The Mobile Money service is limited to one account per Mobile Cell Number, LCMMMI reserves the right to close one or more multiple Mobile Money accounts if it has reasonable grounds to believe they are held by the same person and/or that any one or more of the multiple accounts is being used for illegal, fraudulent, suspect, disreputable or improper purposes.

4.2. The applicant must ensure that all information provided upon registration is accurate and true. LCMMMI reserves the right to deactivate, suspend or close an Account if it transpires that any information provided by the applicant/Account Holder was inaccurate, misleading or false. The applicant must notify LCMMMI as soon as possible following any changes in the details on his/her application.

4.3. LCMMMI may decline an application acting in its absolute discretion or refuse to open a Mobile Money Account if is not satisfied with proof of identity offered by the applicant however, LCMMMI is not obliged to undertake unusual or disproportionate identity checks to verify the applicant’s identity or identification documents.

5. FEES AND OTHER CHARGES

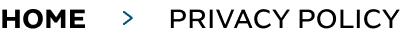

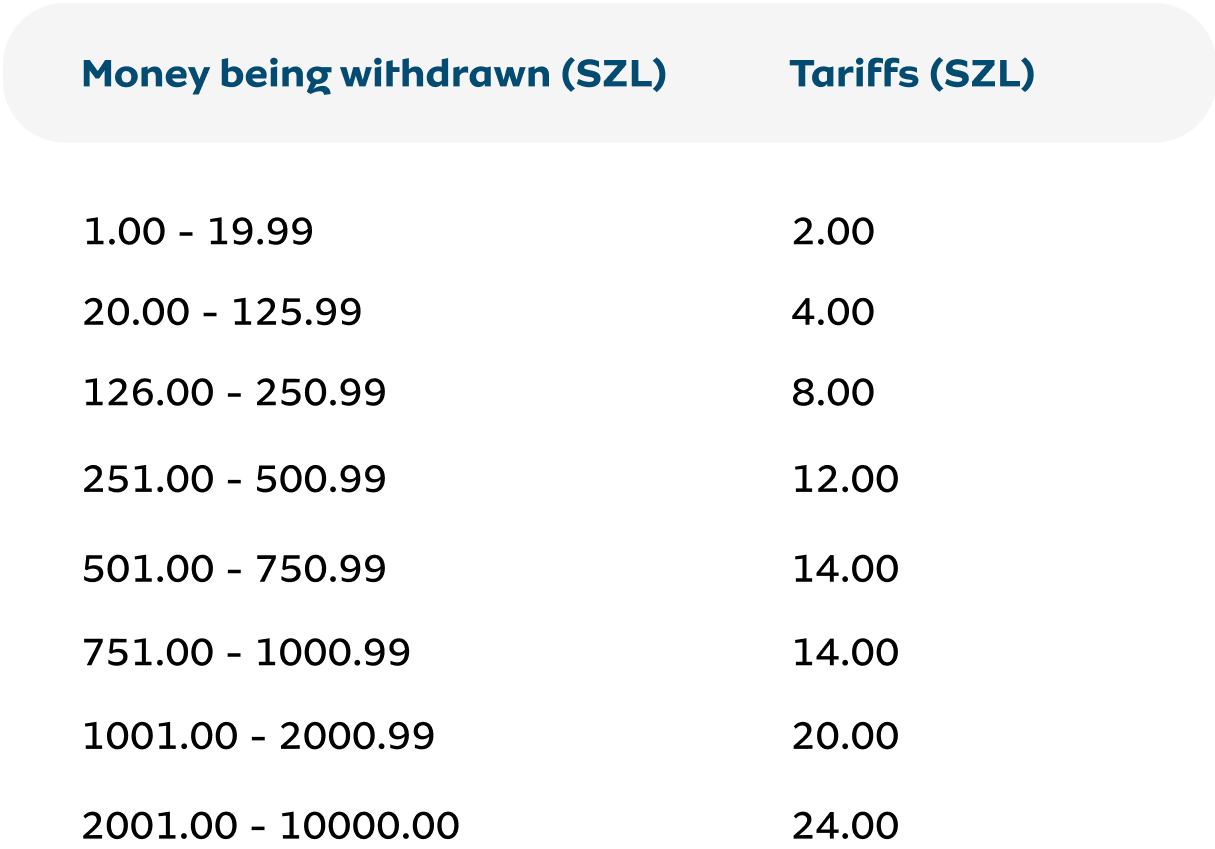

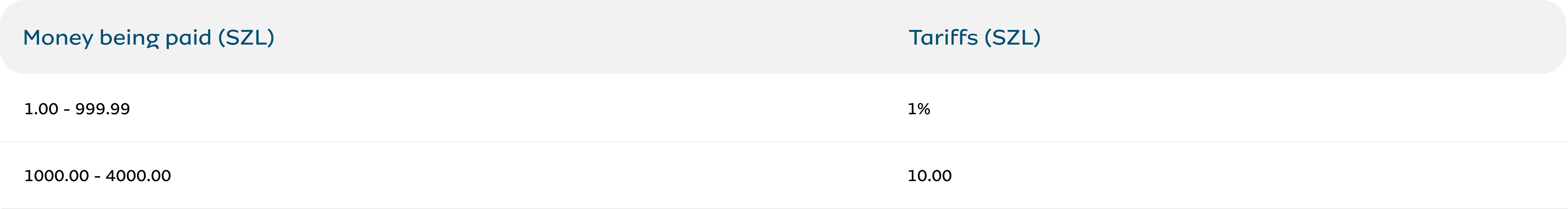

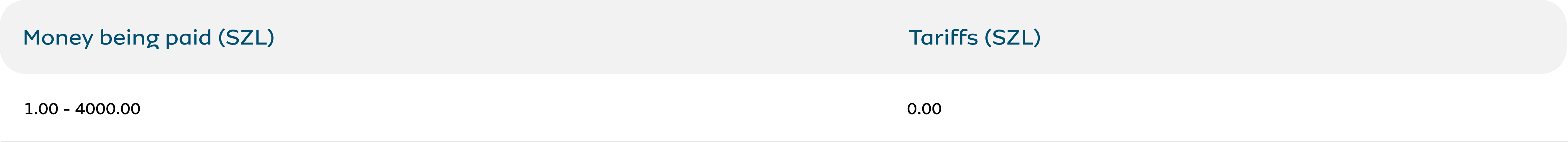

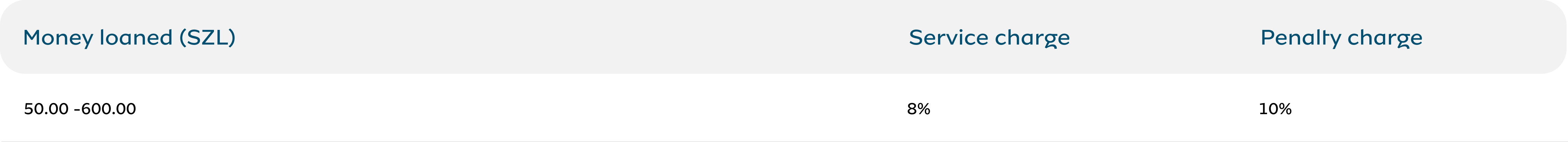

5.1. LCMMMI will charge fees on Mobile Money transactions which fees and details of such fees are available at LCMMMI head office, outlets, POS, Company Website and by contacting Lonestar’s Call Centre.

5.2. All fees will be deducted automatically from the Account following any chargeable transaction without further reference to the Account Holder. The Account Holder hereby consents to automatic deductions.

5.3. Fees are subject to such applicable levies and taxes as are or will be imposed by the Government of Liberia.

6. SECURITY AND UNAUTHORISED USE

6.1. The Account Holder must select a confidential Personal Identification Number (PIN) during registration for Mobile Money Services.

6.2. This PIN is used to correctly identify the Account Holder and is mandatory for the activation of all Mobile Money transactions such that no transaction will be effected without entering and validating this PIN.

6.3. The Account Holder must ensure the PIN is composed out of sight of all persons to maintain confidentiality and appropriate levels of security.

6.4. The Account Holder has three (3) attempts to enter the correct PIN for any activity. If the Account Holder enters the wrong PIN on his/her third attempt, the Account will be disabled and the Account Holder will have to contact Lonestar in order to receive a new PIN.

6.5. The Account Holder is responsible: (a) for keeping the PIN secret; (b) for all transactions that take place using the PIN; (c) for keeping the Phone secure during any transaction after the PIN has been entered but before completion of the transaction; and (d) to indemnify LCMMMI against any and all claims made in respect of such transactions.

6.6. The PIN may be changed via the handset.

6.7. If at any time the Account Holder believes or know that the Phone SIM card or PIN has been lost, stolen or otherwise compromised, the Account Holder may change the PIN via the handset or if circumstances dictate contact and report the occurrence to Lonestar. Following receipt of the report, Lonestar will block the Account as soon as reasonably possible. However, the Account Holder remains responsible for all transactions that occur up to the date and time that the PIN is blocked by Lonestar.

6.8. Only one PIN can be linked to the Account Holder’s Account at any time.

7. TRANSACTIONS

7.1. The Account Holder must have an active SIM card, a PIN and an operational Phone to access Mobile Money Services.

7.2. All transactions will be in Liberian and United States Dollars however LCMMMI reserves the right to introduce new currencies in conjunction with or as an outright replacement of the existing currency.

7.3. All transactions must be authorized using the PIN.

7.4. Mobile Money Accounts have daily limits beyond which an Account Holder may not exceed.

7.5. The aggregate of all daily transactions in the Mobile Money Account may not exceed US$2,000 (Two Thousand United States Dollars) or its equivalent in Liberian Dollars. In the event the daily limit is exceeded, the transaction will be declined. LCMMMI reserves the right at any time in its absolute discretion to increase or lower the daily Debit limits.

7.6. Lonestar reserves the right at any time in its absolute discretion to vary credit limits imposed on transactions as part of the terms and conditions of Mobile Money.

7.7. Transaction Limits

The Central Bank of Liberia regulations CBL/RSD/003/2014, section 15; Level 1 Accounts are subject to a maximum balance limit of US$1,000, an aggregate daily transaction limit of US$250 and an aggregate monthly transaction limit of US$2,000 or its equivalence for Liberian Dollars transactions.

Level 2 Accounts are subject to a maximum balance limit of US$4,000, an aggregate daily transaction limit of US$1,000 and an aggregate monthly transaction limit of US$8,000 or its equivalence for Liberian Dollars transactions.

Level 3 Accounts are subject to a maximum balance limit of US$10,000, an aggregate daily transaction limit of US$2,000 and an aggregate monthly transaction limit of US$20,000 or its equivalent for Liberian Dollars transactions.

Over-the-counter transactions are subject to a single transaction limit of US$100 or its equivalence for Liberian Dollars transactions.

7.8. Any record of a deposit into an Account will be verified and confirmed by LCMMMI. LCMMMI’s records will be taken as correct and authentic unless the contrary is proven.

7.9. LCMMMI will not complete any transactions where the Account Holder has insufficient funds. LCMMMI is not obliged to complete any transaction where the account has sufficient funds to cover a transaction but does not include sufficient funds to pay any fees chargeable.

7.10. The Account Holder must advise LCMMMI as soon as reasonably possible upon becoming aware of any transaction error however LCMMMI is under no obligation to stop, cancel, reverse or alter any transaction for any reason once it has been submitted for processing.

8. STATEMENTS

8.1. The Account Holder may obtain a free SMS statement which will show the last five (5) Account transactions by dialing *156# and following the on-screen instructions.

8.2. The Account Holder is required to check his/her statement and inform LCMMMI within sixty (60) days of the date of the statement if the statement is not correct. In the event of the Account Holder’s failure to notify LCMMMI of any mistake on the statement within the said sixty (60) days period, the Account Holder waives the right to dispute any transactions reflected on the statement or to recover any losses, if any, from unauthorized transactions reflected on the statement.

8.3. Printed statements of the Account are available upon request in person at Lonestar head office.

9. SUSPENSION, DISCONNECTION OF SERVICES, CLOSURE OF ACCOUNT

9.1. LCMMMI reserves the right in its sole discretion without informing the Account Holder and without any liability to the Account Holder to bar, restrict activity, limit or suspend access, disconnect Services or close the Account in the following circumstances: (i) upon request from the Account Holder; (ii) if LCMMMI is aware or has reasonable grounds to suspect that the Account or the Mobile Money Services are being used in an unauthorized, unlawful, improper or fraudulent manner or for illegal or activities (or have been so used previously); (iii) if the Account Holder is in breach of these terms and conditions; (iv) if the Account or phone line (i.e. SIM card) is not used for six (6) months; (v) if LCMMMI is required to close such Account in order to comply with the law; (vi) in the case of force majeure; (vii) if the Account Holder is no longer an active Lonestar subscriber except in the case of post-paid customers who continue to meet contractual payment obligations; (viii) if the Account Holder has reported the Account compromised or his/her PIN or Phone lost, stolen, compromised or damaged; or (ix) in order to protect the operation or security or integrity of the Mobile Money Service, Lonestar’ s network or LCMMMI business and reputation.

9.2. Where the Account has been closed in accordance with 9.1(i) or 9.1(iv) any credit balance in the Account will be repaid to the Account Holder in person upon proper verification of the Account Holder’s identity in LCMMMI reasonable discretion.

9.3. LCMMMI will not be responsible to the Account Holder for any direct, indirect, consequential or special damages arising from any act or omission by us or any third party for whom we are responsible, whether arising in contract, or statute, if the Account is restricted, suspended, disconnected or closed in accordance with this paragraph.

9.4. The Account Holder agrees that his/her information, including his/her personal information, telephone conversations with Lonestar’s Call Centre, his/her transactions and correspondence may be recorded and stored for up to five (5) years from date of closure of the Account.

10. CORRESPONDENCE AND NOTICES

10.1. The address provided on the Mobile Money Registration Form is regarded as the Account Holder’s chosen address where notices may be given and documents in legal proceedings may be served.

10.2. LCMMMI may send information, updates, promotional items, advertising and notifications to the Account Holder via SMS to the contact number supplied on the Account Holder’s application form.

10.3. Any legal notice from the Account Holder to LCMMMI should be delivered to LCMMMI head office: LBDI Building, Tubman Boulevard, Congo Town, P.O. Box 10-4673, Monrovia, Liberia marked FAO: Senior Manager, Mobile Money.

11. INFORMATION, DEBT COLLECTION AND FRAUD PREVENTION

11.1. Information provided by the Account Holder will be held securely by LCMMMI. LCMMMI may disclose information about you to credit reference agencies, debt collection agencies and other Lonestar Group companies for the above purposes, including details of any defaults in payments or repayments of your financial facilities.

11.2. The Account Holder, consents to LCMMMI:

11.2.1 carrying out identity and fraud prevention checks and sharing information relating to the application with the Liberian Police or any fraud prevention or security agency;

11.2.2. providing details to the Liberia Police or any fraud prevention or security agency of any activity on the Account which gives LCMMMI reasonable cause to suspect that the Account is being used improperly, fraudulently or for illegal purposes; and

11.2.3. the Account Holder understands and agrees that the record of this suspicion will then be available to other fraud prevention or security agency should they decide to carry out credit or other checks against the Account Holder’s name.

12. AMENDMENT TO TERMS & CONDITIONS

12.1. LCMMMI reserves the right to vary at any time from time to time and without prior notice to amend these terms and conditions or any of the fees. Any amendment will not constitute a nullification of these terms and conditions LCMMMI will use reasonable endeavors to bring the amendments to the Account Holder’s attention including where appropriate via SMS, display at Lonestar’s head office or POS, www.lonestarcell.com in the media provided always that the Account Holder shall be deemed to have been notified of any such amendments regardless of whether or not they have actually come to the Account Holder’s attention.

12.2. By continuing to use the Mobile Money service the Account Holder shall be deemed to have agreed to all amendments. If the Account Holder does not accept any one or more of the amendments then you must not continue to carry out transactions.

13. GENERAL

13.1. The Account Holder is required to notify LCMMMI if the Account Holder becomes bankrupt or has any financial judicial judgments entered against it.

13.2. All copyright, trademarks and other intellectual property rights used as part of the Services are owned solely by Lonestar, its affiliates and licensors. The Account Holder agrees that he/she acquires no rights therein or thereto.

13.3. The Account cannot be transferred to any mobile telecommunications operator.

14. LIABILITY AND EXCLUSIONS

14.1. LCMMMI will use reasonable endeavors to ensure continuous access to Mobile Money Services however LCMMMI is not responsible for any loss suffered by the Account Holder as a result of the Account Holder being unable to use the Service.

14.2. Not all Phones will be capable of accessing and using Mobile Money. LCMMMI accepts no responsibility or liability for the inability of the Account Holder’s Phone to access or use Mobile Money or for any loss or damage to the Phone resulting from the Account Holder’s actual or attempted access or use of Mobile Money and the Account Holder must satisfy itself as to these matters prior to actual or attempted use of Mobile Money.

14.3. LCMMMI is not responsible for any loss arising from any failure, malfunction, or delay in the network, Phone or resulting from circumstances beyond its reasonable control.

14.4. If LCMMMI is compelled to change or reassign the Account number to satisfy regulatory requirements or for any other reason LCMMMI will either create a new account or close the Account and pay the outstanding balance to the Account Holder.

15. ESCROW ACCOUNT

15.1. Mobile Money sums shall be held in escrow with a bank selected by LCMMMI acting in its absolute discretion (“the Escrow Account”) and the Account Holder shall be beneficially entitled to the amounts stated on the Account Holder’s statement. The Account Holder acknowledges he/she will have no entitlement whatsoever to any interest earned on the Escrow Account.

16. JURISDICTION AND DISPUTE

16.1. These terms and conditions are governed by Liberian law. The parties agree to use reasonable endeavors to settle any disputes amicably failing which the parties will submit their dispute to the Liberian courts for resolution.

1.1. These Terms and Conditions set out below are applicable to all Mobile Money Products and Services.

1.2. These Terms and Conditions and any amendments or variations thereto take effect on their date of publication and/or your acceptance by performing any Transaction on the Mobile Money Service.

2. DEFINITIONS

The following terms will have the specific meanings assigned to them in these “Terms and Conditions.”

2.1.. “Mobile phone” means a GSM terminal connected via a GSM radio link to the Mobile Telecommunications Network (MTN).

2.2. “Cash” means the lawful currency of the Republic of Rwanda.

2.3. “Credit/Cash-in” means depositing funds in your Wallet.

2.4. “Customer” means any person registered on Mobile Money Services

2.5. "Debit/Cash-out" means the movement of funds out of your Wallet.

2.6. “E-money Issuer” means MMRL, or any other payment service provider authorized to issue e-money under the Regulations governing e-payment.

2.7. "GSM" means the Global System for Mobile communications as defined in the European Technical Standards Institute's list of specifications.

2.8. "Guardian" means a parent or legitimate guardian to a minor who wishes to open a Mobile money wallet.

2.9. "Agent" unless defined otherwise in the regulation of the Central Bank governing agents, means a person providing services of an e-money issuer to the customers on behalf of the e-money issuer under a valid agency agreement.

2.10. “Inactive wallet” means a Mobile money wallet which is or has been inactive for a period of six (6) months, counted from the date of last transaction.

2.11. "Dormant wallet" means a Mobile money wallet that remains inactive for a period of six (6) months, counted from the date of last the notification of such inactivity and in total of twelve (12) months of inactivity.

2.12. "Unclaimed funds" means the money that remains unclaimed in the wallet for a period of 5 years from the date of last transaction.

2.13. "Our Website" refers to the website address https://www.mtn.co.rw

2.14. "Mobile Money" refers to the mobile financial services product through provision of a mobile phone Wallet that enables customers to carry out various payment transactions from their mobile phones.

2.15. "MTN" refers to MTN Rwandacell Plc.

2.16. "MMRL" refers to Mobile Money Rwanda Limited and in some instances may include MMRL’s parent company, MTN.

2.17. "Partner Banks” refers to KCB, I&M Bank, Bank of Kigali, ZIGAMA CSS, Equity Bank, GTBank, Vision Finance, BPR, Unguka, Cogebanque, Access Bank, NCBA Bank, Bank of Africa, Amasezerano, AB Bank and/or any other Bank that may be signed on to the Mobile Money Service from time to time.

2.18. "Person" means a natural person or legal entity.

2.19. "Personal Data" means any data and/or information which uniquely identifies, or is capable of identifying a customer, including without limitation to data and/or information of any MMRL customer who sends or receives money and/or who does any other transaction via the Mobile Money platform.

2.20. “PIN” means Personal Identification Number being the secret code you choose for your transactions without which Wallet transactions cannot be executed.

2.21. "POS" means a Point-of-Sale device (Tap and Pay) which is used for Mobile Money transactions.

2.22. "RWF" means Rwandan Francs, being the transacting currency acceptable under this agreement.

2.23. "Services" refers to the services provided by us relating to your Mobile phone to enable you to use Mobile Money.

2.24. “SIM Swap” means the process of replacing an existing SIM with a new one or moving the existing number to the new SIM.

2.25. "SMS" means a Short Messaging Service consisting of a text message.

2.26. "Wallet" refers to a customer’s Mobile Money transactional account which is accessed primarily through their mobile phone.

2.27. "Wallet holder" refers to the person in whose name the Mobile Money Wallet is registered.

2.28. “We” or “Us” refers to Mobile Money Rwanda Limited.

2.29. "You" or “Your” or “Customer” means the Wallet holder.

2.30. RNDPS (Rwanda National Digital Payment System), means an instant payment system that enables sending and receiving funds from and to various payment service providers (Banks, MFIs, SACCOs, E-money Issuers).

3. MOBILE MONEY SERVICE

3.1. The Mobile Money service enables you to carry out various financial transactions from their mobile phones, or through any Mobile Money Authorized Agents. These transactions include but not limited to mobile money transfers, bill payments, deposits, withdrawals, and airtime purchases or any other services that may from time to time be provided to you.

3.2. Mobile Money Wallets are opened on Mobile Money Platform and this service is currently available to anyone who meets requirements set by MMRL and the Central Bank of Rwanda. You commit to use Mobile Money in accordance with these terms and conditions and any amendment to these terms and conditions.

3.3. Mobile Money can be used to transfer payments to any licensed e-money issuer in Rwanda through the RNDPS, and you can also access Mobile Money services while Roaming Internationally unless otherwise notified by MMRL.

4. ACCEPTANCE OF TERMS AND CONDITIONS

4.1. Before subscribing and performing any transaction using the Mobile Money Service, you must carefully read and understand these terms and conditions (“rules”) which shall govern the use of Mobile Money Services as they are set out in this document.

4.2. Upon clicking the option “Accept” Option on the Mobile Money Menu as the Data Subject, you confirm that you have read, understood and agreed to abide with these terms and conditions.

4.3. By using or continuing to use the Mobile Money Service, you consent to the collection, processing and transferring of your personal information (“personal data”) and you voluntarily provide to MMRL and/or any third party contracted by us to collect process and/or transfer such personal data by method and/or means that shall be used by us at our sole discretion.

4.4. By agreeing with these terms and conditions you agree to share your name and account details with participants in RNDPS in order to facilitate the sending and receiving of payments to and from other e-money issuers, as well as to enable perform tracing of payment and conducting investigation where it is required. You must keep your details up to date by informing us of any changes to your details through our Service Centers.

4.5. You may choose to withdraw consent for your personal information to be shared with RNDPS by notifying us through USSD or dial *182#.

4.6. You acknowledge and accept that the Personal Data which relate to your person represent the referred to personal data within the meaning provided under these Terms and Conditions and/or in accordance with the Law Nº 058/2021 of 13/10/2021 Relating to the Protection of Personal Data in Rwanda on the protection of natural and/or moral persons with regard to the processing of personal data and/or as it may be amended from time to time. You further declare that you are at least 16 years old and if not then you confirm that such consent has been expressed or given by the person who has the parental responsibility for you or your guardian.

4.7. You accept that your personal data which is and/or will be collected and/or stored during registration for Mobile Money services in your names, including telephone conversations that will be collected and /or stored through or by MMRL customer care representative or personnel and any transactions conducted on your Mobile Money Account(s)/wallet(s), may from time to time be utilized, stored, processed and/or shared by MMRL for purposes of optimizing the service convenience and/or enabling customers and enhance your experience and will be recorded and stored for record keeping purposes as per regulatory requirements.

4.8. We undertake to protect your collected data and shall ensure shared data is well protected, from misuse and unauthorized access or disclosure by any receiving party (recipient). In the case of transmission of personal data to third parties and/or countries, MMRL shall have sufficient control mechanisms for their protection.

4.9. You hereby expressly consent and authorize us to transfer your personal data in particular:

4.9.1. To and from any local, international law enforcement, competent regulatory and/or governmental agencies so as to assist in the prevention, detection, investigation or prosecution of criminal activities or fraud and/or competent regulatory or government authorities for the purpose of fulfilling our statutory obligations prescribed by relevant legal regulations.

4.9.2. To MMRL service providers, dealers, agents or any other company that may be or become MMRL’s subsidiary or holding company for reasonable commercial purposes relating to the Services.

4.9.3. To MMRL lawyers, auditors or other professional advisors or to any court or arbitration tribunal in connection with any legal or audit proceedings.

4.9.4. For reasonable commercial and/or contractual purposes connected to your use of the Services, such as marketing and research related activities; and

4.9.5. In business practices including but not limited to quality control, training and ensuring effective systems operation.

4.9.6. To any other relevant recipients/categories of recipients with domiciles outside Rwanda to the extent permitted by the law.

4.9.7. You may withdraw consent for such use, processing or transfer of Data as set out herein, except as it is required to: (a) carry out fraud detection; or (b) comply with any statutory or regulatory requirement or the order of a court or other public authority, by sending written notice to MMRL in the prescribed form, available from MMRL on request.

4.10. Notwithstanding anything contained herein, any rejection of these terms and conditions and/or consent withdrawal of any terms stipulated herein will result into cancellation of your subscription on all Mobile Money services and/or rejection of your application for Mobile Money Wallet.

5. APPLICATION FOR WALLET

5.1. You understand that you can only apply for a Wallet if you are an active customer:

5.1.1. Rwandan citizens with a valid National ID Card, Passport or national driving license may apply for a Mobile Money Wallet.

5.1.2. Foreigners wanting to benefit from this service will be required to present an original valid passport, a laissez Passer, or a letter from their employer confirming employment and or a valid Employment visa (if available).

5.2. You ascertain that any information provided to MMRL is true and accurate and that you may be requested to provide any additional information that is required from time-to-time failure will result in suspension or closure of the wallet.

5.3. Persons below the age of 16 (minors) can open a Mobile Money Wallet with a Guardian. The Guardian will have to provide some information on a Guardian form, and which will be signed by the latter.

5.4. If we believe that the information provided by your is not sufficient proof of your identity, we are entitled to decline your application to open a Wallet or to revoke the same at any stage at our sole discretion.

6. FEES AND OTHER CHARGES

MMRL shall charge you fees for use of the Mobile Money service. The details of the applicable fees for the various Mobile Money services and products are available at all our Service Centers, from authorized Mobile Money Agents, by contacting our Call Centre on 100, or by accessing our website https://www.mtn.co.rw/momo/personal/momo-tariffs/

7. TRANSACTIONS / LIMITS

7.1. To manage your money safely there are transactional and daily limits on your Wallet. You can only transact within the daily limits approved by the Central Bank as may be amended from time to time.

7.2. You may access the available funds in your Wallet at any time using your mobile phone. While we will perform the services and carry out our obligations under these terms and conditions with all due diligence and efficiency in accordance with the generally accepted techniques and practices commonly recognized by the industry, we acknowledge that the Service is not fault free and the quality and availability of the Service may be affected by factors outside the control of MMRL such as local geographic or physical obstructions, atmospheric conditions and other causes of radio interference as well as faults in other telecommunication networks to which the Network is connected or dependent.

7.3. You must authorize your transactions with a secret PIN that you create when you apply for the Mobile Money service and/or by such other method we may prescribe from time to time.

7.4. You must always check the balance on your Mobile Money wallet before and after authorizing and or initiating any transaction to ensure that your balance reflects the initiated and or authorized transaction. After every transaction, a notification will be sent to your mobile phone.

7.5. You must at all times count the cash received and confirm your balance immediately after a cash out transaction.

7.6. You must always confirm your balance immediately after a cash in transaction.

7.7. You will not be permitted to withdraw, transfer or make any payments that are above the daily transactional limits. Should you exceed any of these limits, your transactions will be declined.

7.8. In addition to 7.7 the monthly balance on your Wallet may at no time exceed the prescribed Central Bank limit.

8. SECURITY AND UNAUTHORIZED USE

8.1. You are required to select a confidential PIN during registration. This PIN is mandatory for the use of all Mobile Money features in such a manner that no transaction could be effected without entering and validating this PIN. You have three (3) attempts to enter the right PIN. If you enter the wrong PIN on failure of your third attempt, the Mobile Money wallet will be blocked. In the event that the wallet is disabled, you can call the call center to reset your PIN for any amount equal or below Frw 20,000 and you can visit your nearest Service Centre for your PIN Reset.

8.2. You are responsible, for keeping your PIN secret and for all transactions that take place on your Wallet with your PIN and you indemnify us against any claims made in respect of such transactions. Your PIN shall not be communicated to anyone, must be kept in a very confidential manner and should in no case be written on any document. You must ensure this PIN is always composed out of sight of any individual.

8.3. If at any time you believe or know that your Mobile phone or PIN has been stolen or compromised, you should immediately change your PIN, call us on 100 (Toll Free) or visit any of our Service Centre for your PIN to be reset or Wallet unblocking. We will block the PIN as soon as we reasonably can. You will remain responsible for all transactions that occur until your PIN is blocked.

8.4. Should you dispute that any purchase or withdrawal debited to your Wallet was not authorized by you, you will have to prove it was not authorized.

9. STATEMENTS

9.1. You may upon written application request a statement printout from us showing all the transactions on your Wallet. You must check each statement as soon as you receive it and inform us within 30 days of the date of the statement if you think that a statement is not correct. If you do not do this within this timeframe you hereby waive the right to dispute any transactions reflected on the statement or to recover any losses from unauthorized transactions reflected on the statement.

9.2. You can use your mobile phone to request your balance or mini statement on your Wallet or alternatively you may visit any of our service center to request for your statement.

10. CLOSING YOUR WALLET

10.1. We will close your Wallet upon receiving a closure request from you.

10.2. We can close your Wallet, restrict activity on your Wallet or suspend access to your Wallet if in any way we know or suspect your Wallet is being used fraudulently, negligently or for illegal activities or if we must do so to comply with the Law.

10.3. We can close your Wallet if we believe that you are in breach of these terms and conditions, are trying to compromise our systems or are unreasonably interfering with any Services provided by us.

10.4. We may choose at any time to close your Wallet to protect our business interests should we suspect your wallet to be involved in any fraudulent actions, money laundering or any other suspicious action that violates these terms and conditions, any laws, rules and or regulations under which we operate.

10.5. Where your mobile money wallet is Inactive, we shall inform you that it is about to be or has already been classified as Inactive and your required to reactivate it. Where the wallet holder fails to reactivate the mobile money wallet for a period of six (6) months counted from the date of the last notification of such inactivity, it shall be flagged in our database system as “Dormant” and in that case you will be required to visit our service center to reactivate it.

10.6. We may close your Wallet if you are no longer a Mobile Money customer, or your Wallet remains Inactive or Dormant for a period of 24 months.

10.7. Unclaimed funds on your wallet that have been dormant for five (5) years shall be transferred to the Central Bank by us within a period not exceeding thirty (30) days from the end of the five (5) years.

10.8. We will not be responsible to you for any direct, indirect, consequential or special damages arising from any act or omission by us or any third party for whom we are responsible, whether arising in contract, delict or statute, if we close or suspend your Wallet in terms of this clause 10.

11. FAILURE OR MALFUNCTION OF EQUIPMENT

We are not responsible for any loss arising from any failure, malfunction, or delay in any POS, cellphone networks, and Mobile phones, the Internet or terminals or any of its supporting or shared networks, resulting from circumstances beyond our reasonable control.

12. NOTICES

12.1. The address you supply on your Mobile Money Registration Form is regarded as your chosen address where notices may be given. You must notify us immediately should your physical, postal, email address or Mobile phone number change.

12.2. We are entitled to send any notice to an email address specified on your application. This communication will be regarded as having been received by you, unless the contrary is proved. This clause pertains to customers who have completed the Mobile Money Registration Form.

12.3. We are entitled to send information to you via SMS to the contact Mobile phone number provided on your application form and as amended from time to time. These SMS’ are for Mobile Money services’ information and or Mobile Money services promotional purposes only.

12.4. Your legal notices and documents in legal proceedings will be served to us at our chosen address:

Mobile Money Rwanda Limited

MTN Centre Building, Nyarutarama

Kigali-Rwanda

12.5. You acknowledge and agree that this agreement will be regarded as having been entered into in Kigali and any breach of this agreement will be considered as having taken place in Kigali.

13. CONSENTS AND CONDUCT OF THE WALLET

13.1. You, the Wallet holder, consent to us:

13.1.1. Making enquiries about your credit record with any credit reference agency and any other party to confirm the details on this application.

13.1.2. Providing regular updates regarding the conduct of the Wallet to the credit reference agencies and allowing the credit reference agencies to in turn make the record and details available to other credit grantors.

14. FRAUD PREVENTION

14.1. You, the Wallet holder, consent to us:

14.1.1. Carrying out identity and fraud prevention checks and sharing information relating to this application with the Rwanda Police or any fraud prevention or security agency as required by Law.

14.1.2. Providing details to the Rwanda Police or any fraud prevention or security agency of any conduct on your Wallets that gives us reasonable cause to suspect that the Wallets are being used for improper purposes; and

14.1.3. You understand and agree that the record of this suspicion will then be availed to other members of the Rwanda Police, or any fraud prevention or security agency should they carry out credit or other checks on your name.

15. GENERAL

15.1. We may vary or amend at any time these Terms and Conditions and the Transaction Fees and without notice to you. Any such variations or amendments will be published in the daily newspapers and/or our website and/or by any other means as determined by us and any such variations and amendments shall take effect within thirty (30) days following publication.

15.2. You shall not vary any of these terms and conditions.

15.3. You agree that we may sue you in any court of competent jurisdiction in Rwanda.

15.4. A favor or concession we may give you will not affect any of our rights against you.

15.5. These terms and conditions are governed by Rwandan Laws.

15.6. We may allocate any money received from you or held on your behalf to settle any outstanding balance on your Wallet with respect to subsisting loans. Should you default on your Wallet while at the same time having a credit balance due and payable on any other Wallet with Partner Banks, we have the right to apply set-off on the affected Wallets.

15.7. You must notify us if you are under an administration order, sequestration or any other form of insolvency.

15.8. You must pay all our expenses in recovering any amounts you owe us including legal fees.

15.9. A certificate signed by any of our representatives (whose appointment need not be proved) showing the amount you owe us is sufficient proof of the facts stated on the certificate, unless the contrary is proved.

15.10. We will not be responsible to you for any indirect, consequential or special damages arising from any act or omission by us or any third party for whom we are responsible and whether arising in contract, statute or tort.

15.11. We are not responsible for any loss from any failure, malfunction, or delay in any mobile network, mobile phones, the internet or terminals or any supporting or shared network resulting from circumstances beyond our reasonable control.

15.12. MMRL reserves the right at its sole discretion, to suspend or terminate the agreement if you use your account for unauthorised purposes, or to suspend or terminate this agreement wholly or partially due to your abuse of any of the Mobile Money services and/or functionalities provided to you for purposes of utilization of Mobile Money services.

15.13. You must notify us immediately of any change to any of the details in your application, particularly details shared for the purposes of Article 4.3 to 4.7 herein.

15.14. You agree that your information, including your personal data, your telephone conversations with our call center and your transactions will be recorded and stored for record keeping purposes for ten (10) years from date of closure of Wallet.

15.15. We are obliged by Law to regularly update your personal particulars, such as your current residential address and contact information. We may contact you from time to time in this regard.

15.16. Neither party hereto shall be liable for any breach of its obligations hereunder resulting from events beyond its reasonable control including but not limited to strikes, riot, acts of war, terrorism or revolution, acts of God, civil commotion, strikes, labour disputes, fires, floods, destructive lightening, epidemic, system downtime, system malfunction, internet service interruptions, hacker attacks, vandalism, governmental demands or requirements. If such event continues for at least thirty (30) days, then the other Party may terminate this agreement by notice to the other in writing without incurring any additional liability.

15.17. All copyright, trademarks and other intellectual property rights used as part of our Services or contained on our documents are owned by MMRL or its licensors. You agree that you acquire no rights thereto and any unauthorized reproduction, modification, distribution or republication of materials or intellectual property, without the express prior written consent of MMRL is strictly prohibited

15.18. You accept that all transactions effected on your mobile phone are subject to other applicable Regulations and Terms and Conditions available on our website or from our call Centre.

16. SANCTIONS

16.1. Any abusive and/or fraudulent usage of your Mobile Money Wallet and any false declaration may be punished by the Laws in place in Rwanda.

16.2. Any abusive and/or fraudulent usage of your Mobile Money Wallet and any false declaration may also lead us to suspend temporarily or indefinite rights to access to Mobile Money services.

16.3. Any cost engaged by us in recovering transactions and undue payments made by you, will be borne by the user legal interest rate.

16.4. Any transaction or action from you on your Mobile Money Wallet triggering a malfunction of the system and requiring a technical intervention will be charged to you.

17. YOUR RESPONSIBILITIES

17.1. You will be responsible for payment of all applicable fees for any transaction effected using Your Mobile Money Wallet whether these were made by you or someone else with or without your authority or knowledge.

17.2. You must not use the Service to commit any offence(s); Fraud and Money Laundering and any other financial offence that is not accepted under the laws of the country or contravenes the Laws governing payment systems and the Law on prevention and penalizing the crime of money laundering and financing terrorism.

17.3. In case of any complaints regarding the service, you must lodge the said complaints within a period of thirty (30) calendar days from the date of detection of the anomaly, we shall acknowledge receipt of the complaint lodged and have maximum of 30 working days to resolve it and or respond to the Customer.

17.4. You must use one of the following medium in lodging your complaint(s) within the specified time period provided in Clause 17.3 above, Call Center on the number 100 (Toll Free), Visit to Service center or via electronic mail from our website.

17.5. In the event that you are not satisfied with the feedback provided by MMRL on your complaint, you may refer the matter to the National Bank of Rwanda (BNR) within five (5) days in writing following our response or after the expiry of the timelines specified in clause 17.3 whichever comes first. Notwithstanding anything contained under this clause 17.5, BNR shall attempt to amicably mediate and resolve the matter between the parties, but under no circumstance shall the decision of BNR in relation to the referred matter be binding and executable on the Parties.

17.6. In the event of damage, loss or theft of the SIM card, you are obliged to inform us immediately of such damage, loss or theft. We will then disable the damaged, lost or stolen SIM card so as to prevent possible use of the Mobile Money Services until the SIM card has been replaced. To report a damaged, lost or stolen SIM card, you can call the Call Centre on the number 100 (Toll Free) or visit the nearest Service Centre.

17.7. In the event of a SIM swap or PIN reset, your Mobile Money Wallet will remain blocked for 72 hours after such Sim swap or PIN reset. Should you need to use your Mobile Money Wallet prior to the expiry of the 72 hours period mentioned in this Clause 17.7, you will be required to visit the nearest Service Centre with your valid identification document as mentioned in Clause 5 PROVIDED THAT the same document was used to open your Mobile Money Wallet.

17.8. In case of Fraud or scams, you must subsequently provide details of fraud, scams, or unauthorized transaction and a police extract as part of your complaints to commence the necessary checks. Note that any loss incurred during this period will be a personal liability for which MMRL shall not be responsible.

17.9. We will not be liable for any transactions on your account as a result of damage, loss or theft of your SIM card.

17.10. You must comply with any instructions that we may issue from time to time about the use of the Mobile Money Services.

18. MONEY TRANSFER REVERSALS

18.1. You must lodge a formal complaint of a wrong transfer not later than 30 calendar days from the date of the incident in accordance with the Regulations of the National Bank of Rwanda on electronic fund transfers and electronic money Transactions. Careful investigations will be conducted to establish the claim as part of processing the reversal.

18.2. Where possible we will endeavor to effect reversals of a wrong transfer within 5 working days but in any event not later than 15 working days from the date on which a request was made.

18.3. Where the amount in question is fully available in the Wallet and the recipient does not consent to the reversal as at the time of receiving the complaint, we shall hold the funds for further investigations provided that the recipient has not expended the funds. We can only block the remainder balance on the account where the funds have been partially expended.

18.4. In the event where the amount is not in the Wallet, you would be advised accordingly. We may conduct further investigations in this event to satisfy our internal procedures.

18.5. Provided that you report to us within 30 days of after the transaction, we will take reasonable steps to contact the supposed wrong recipient, through calls and SMS, within 3 working days of receiving a reversal request.

18.6. Where the wrong recipient does not respond to the calls and SMS during the 3 days of contact, you have the responsibility to take on the matter with relevant authorities.

18.7. Where the wrong recipient has been responsive, and investigations concluded showing satisfactorily that it was a wrong transaction, we will endeavor to perform the reversal after the 3 working days of the conclusion of the investigation or notification from relevant authorities.

18.8. We do not have any obligation to perform a reversal in the event of any dispute with any wrong recipient.

18.9. We will make reasonable efforts to reverse the amount reported (if fully intact) or the remaining amount (after partial withdrawal by the wrong recipient) and in both cases, the reversal will attract the prescribed fee where applicable.

18.10. We will not be liable for any refunds or damages whatsoever resulting from a wrong transaction.

18.11. If a Mobile Money account is closed as a result of customer’s death, the balance standing to the customer’s account shall be paid over to the next of kin as may be mentioned in the Mobile Money Registration Form and/or the administrator nominated in the letters of administration issued by a competent Court of Jurisdiction or Executors stated in a will.

19. AIRTIME REVERSALS

19.1. Reversals cover only airtime purchased from your own wallet.

19.2. The reversal can only be initiated and completed by you.

19.3. Airtime purchased can be reversed within 72 hours of purchase, failure of which, the reversal cannot be processed. You are required to immediately communicate to us of such error on 100 (Toll Free). We will block the airtime as soon as we reasonably can as we await completion of the investigation on the matter as set out herein.

19.4. You can reverse airtime only once a week. Transactions below RWF 50,000 cannot be reversed.

19.5. No partial reversal is allowed. You need to ensure that the full value of airtime purchased, and the bonus amount received is available before the reversal can be processed.

19.6. In case some part of the bonus or main airtime has been used by you, the transaction cannot be reversed. You have the opportunity to top-up to ensure that the full amount is available to be able to reverse.

19.7. Transaction notification will be sent to both the sender and receiver upon completion of the reversal.

20. WARRANTIES, AND LIMITATION OF LIABILITY

20.1. MMRL will report any suspicious account activity to the relevant law enforcement authority

20.2. MMRL shall use all reasonable efforts to ensure that all services and/or requests are processed in a timely manner. However, MMRL makes no representations or warranties as to continuous, uninterrupted or secure access to the Mobile Money service, which may be affected by factors outside MMRL ’s control and which may be subject to periodic testing, repair, maintenance or upgrades.

20.3. MMRL will not by reason of representation, implied warranty, condition or other term be liable for any damages or losses, including, without limitation, direct, indirect, consequential, special, incidental or punitive damages deemed or alleged to have resulted from or caused by but not limited to:

i) transactions made to unintended recipients or payments made in incorrect amounts due to the input of incorrect information by you;

ii) transactions made from your account by an unauthorized third party who passes all identity and verification checks;

iii) any fraud or misrepresentations by any Mobile Money Agent only,

iv) failure of any other payment system, electronic money transfer system or data transmission system other than the Mobile Money system

v) any intentional or negligient acts and/or omissions by any other e-money issuer and/or payment system service provider

You agree to indemnify and hold MMRL harmless against any claim brought against MMRL by a third party resulting from your breach of these Terms and Conditions.

21. DISPUTE RESOLUTION

21.1. All or any disputes arising out or touching upon or in relation to these Terms and Conditions, including the interpretation and validity of the terms thereof and the respective rights and obligations of the Parties, shall be settled amicably by mutual discussion, failing which the same shall be settled through the relevant Commercial Courts in Kigali.

Chaque fois qu’ils seront utilisés dans le présent contrat ou en relation avec son exécution, les termes suivants auront le sens défini ci-après :

PORTEUR : Abonné au service MTN Mobile Money en vertu des présentes, et détenteur de la monnaie électronique pour son propre compte.

MTN : désigne la marque par laquelle est commercialisée les produits et services Mobile Money et AREEBA Guinée S.A.

Mobile Money ou MoMo : est le nom sous lequel est commercialisé les produits et services objet des présentes.

Marchand : Tout commerçant, personne physique ou morale, fournisseur de biens et services, agréé par MTN Mobile Money S.A et habilité à encaisser les dépôts et à effectuer les retraits des PORTEURS et/ou acceptant la monnaie électronique comme moyen de paiement.

Monnaie Electronique : la Valeur monétaire représentant la créance sur l'émetteur, qui est :

- stockée sur un support électronique y compris magnétique (téléphone portable ou carte Sim) ;

- émise contre remise de fond de valeur égale ;

- acceptée comme moyen de paiement par des entreprises autres que l'émetteur.

ARTICLE 2 : OBJET DU SERVICE MOBILE MONEY

Mobile Money est un service innovant permettant à l'échelle nationale, d'effectuer des transactions financières relativement simples à partir du téléphone mobile et d'Internet

Les fonctionnalités potentielles de Mobile Money sont :

- le transfert d'argent (de compte à compte, de compte à cash, de cash à cash) ;

- l'alimentation du compte Mobile Money du PORTEUR avec la monnaie électronique auprès des établissements distributeur de monnaie électronique et de toutes agences MTN Mobile Money S.A

- encaissement et retrait de monnaie en espèce auprès des établissements distributeurs de monnaie électronique et de toutes agences des banques partenaire de MTN Mobile Money S.A

- le paiement des factures,

- l'achat de minutes de communication.

ARTICLE 3 : CONDITIONS DE SOUSCRIPTION ET D'UTILISATION DU SERVICE MTN MOBILE MONEY S.A PAR LE PORTEUR

3.1 Conditions de souscription

- Pour bénéficier du service Mobile Money, il faut :

- Etre âgé de 18 ans révolus ;

- Etre abonné chez l'opérateur de téléphonie AREEBA-Guinée S.A,

- Avoir signé le formulaire de souscription à Mobile Money et y avoir joint un support d’identité valide

- Avoir signé les présentes conditions d'utilisation qui régissent les relations contractuelles entre MTN Mobile Money S.A et l'utilisateur du service

Des dérogations peuvent être accordées pour les mineurs justifiant de leur maturité et assistés par leurs parents.

3.2 Utilisation du service

3.2.1 Alimentation du porte-monnaie électronique

L'alimentation du portemonnaie électronique du PORTEUR se fait contre remise de monnaie en espèce auprès d'une agence de MTN Mobile Money S.A, de AREEBA Guinée S.A, d’un Marchand agrée par MTN Mobile Money S.A ou les banques partenaires de MTN Mobile Money S.A.

Le PORTEUR n'est donc pas tenu de disposer d'un compte bancaire pour pouvoir utiliser le service Mobile Money.

3.2.2 Transfert d'argent

De compte à compte

Il s'agit du transfert d'argent d'un utilisateur Mobile Money vers un autre utilisateur du même service, ou d’un autre service conformément à la règlementation en vigueur.

De compte à cash

Il s'agit du transfert d'argent d'un utilisateur Mobile Money vers un non utilisateur Mobile Money.

Le non abonné devra alors se rendre dans une agence de MTN Mobile Money S.A ou chez un Marchand agrée par ladite société.

3.2.3 L'encaissement d'argent

Le PORTEUR pourra à sa guise procéder à l'encaissement et au décaissement de la monnaie électronique qu'il détient en se rendant à une agence de MTN Mobile Money ou chez un Marchand agrée par ladite société

3.2.4 Le paiement de facture

Cette transaction permettra au PORTEUR de régler depuis son portable ou via Internet, ses consommations auprès des facturiers agréés.

3.2.5 L'achat de minutes de communication

Le PORTEUR pourra procéder via son portable ou Internet ou encore son compte bancaire selon le cas à l'achat de minutes de communication auprès de la société AREEBA Guinée S.A.

Les transactions effectuées via Mobile Money sont exécutées -dans les limites du crédit disponible sur le portemonnaie électronique (support de l'opération).

Le PORTEUR doit, préalablement à chaque transaction s'assurer de l'existence dans son porte-monnaie électronique de la provision suffisante et disponible. A défaut, la transaction ne pourra pas être faite.

Le PORTEUR doit s'assurer de la saisie correcte des données de toutes transactions qu'il effectue.

Les transactions effectuées via Mobile Money sont exécutées dans le respect de la réglementation applicable en République de Guinée, notamment la règlementation des Etablissement de Monnaie Electronique.

3.2.6 Limitation du montant des transactions

Limitation dans la balance

Le montant plafond de la balance du porte-monnaie électronique du PORTEUR est fixé à Cinquante millions (50 000 000) de Francs Guinéens.

Limitation dans les transferts

Le montant maximum pour une opération de transfert est fixé à dix Millions (10 000 000) de Francs Guinéens.

Toutefois ces limites sont susceptibles de modification sans préavis en fonction des exigences du marché ou du régulateur, MTN Mobile Money S.A s’efforcera dans ce cas à communiquer au PORTEUR les nouveaux changements dans un délai raisonnable

ARTICLE 4 : CODE SECRET PERSONNEL

4.1 Attribution et utilisation du code

Le PORTEUR saisira sur son Mobile, le jour de sa souscription un code personnel à 5 caractères numériques.

Il s'engage à garder secret son code personnel et à ne pas le communiquer à qui que ce soit. Le PORTEUR prendra donc toutes les mesures propres à assurer la sécurité de son code personnel. Il doit veiller à ne pas l'enregistrer dans la mémoire de son téléphone portable ou sur tout autre support accessible aux tiers. Il s'engage à détruire les messages dans lesquels figurera son code secret.

Ce code est indispensable dans l'utilisation des services Mobile Money, conçus de façon qu'aucune opération ne puisse être effectuée sans mise en œuvre de ce code secret. Le PORTEUR garantit qu’il est l'auteur de tout ordre émis et transmis au service Mobile Money à travers l’usage de son code secret.

Les transferts d'argent et les paiements faits au moyen de l’usage du code secret du PORTEUR sont considérés exclusivement être effectués par le PORTEUR. Lesdits transferts et paiements sont irrévocables et insusceptibles de recours en remboursement ou en annulation de la transaction.

Le nombre d'essai successif de composition du code secret est impérativement limité à trois (3). Après le troisième essai infructueux, le PORTEUR sans pouvoir engager la responsabilité de MTN Mobile Money S.A court le risque d'invalidation du code. En cas d’invalidation du code, le PORTEUR devra contacter le service client de MTN Mobile Money S.A pour la réinitialisation du code secret. Il lui sera alors demandé de choisir un nouveau code secret pour continuer à utiliser le service.

Le PORTEUR sans pouvoir engager la responsabilité de MTN Mobile Money SA, a la possibilité de réinitialiser lui-même son code secret à condition que son solde ne dépasse dix mille francs guinéens (10.000 fg). Le PORTEUR dont le solde dépasse dix mille francs guinéens (10.000 fg), pourra réinitialiser son code secret à travers la réception d’une notification OTP qui lui est directement envoyer par MTN Mobile Money SA.

4.2 Opposition

L'ordre ou l'engagement de payer donner au moyen de Mobile Money est irrévocable.

Toutefois, il peut être fait opposition au paiement en cas de survenance d’un cas de force majeure survenue avant le paiement effectif.

Par force majeure il s’agit de toute cause à la fois extérieure à la volonté des parties, imprévisible et irrésistible, à savoir une inondation, un glissement de terrain, un incendie, un tremblement de terre, une guerre, des troubles sociaux ou autres sinistres rendant les lieux inhabitables :

L'opposition doit être faite par appel téléphonique ou par écrit dans les vingt-quatre (24) heures ouvrées suivant la survenance de l’évènement. Pour être valable, l'opposition doit être confirmée par le PORTEUR muni de toutes pièces justificatives (déclaration de perte ou de vol contresignées par les autorités policières compétences).

L'opposition doit être faite au service client joignable au numéro 111 pendant les horaires d'ouverture.

ARTICLE 5 : DISPONIBILITE DU SERVICE ET CONTENU

5.1 Disponibilité

- Le service Mobile Money est disponible 7 jours sur 7, 24 heures sur 24 sous réserve de la disponibilité d'accepteurs lorsque la transaction souhaitée en nécessite un.

- Néanmoins, le service peut être momentanément inaccessible afin de réaliser des opérations d'actualisation, de sauvegarde ou de maintenance, ou en raison de défaillance des réseaux de communication utilisés. Dans ces hypothèses, MTN Mobile Money S.A en informera le PORTEUR par message SMS, sauf dans les cas de défaillance du réseau téléphonique empêchant toute communication,

- D'une manière générale, le PORTEUR reconnaît que la disponibilité du Service ne saurait s'entendre de manière absolue, et qu'un certain nombre de défaillances, de retards ou de défauts de performance peuvent intervenir indépendamment de la volonté de MTN Mobile Money S.A ou de AREEBA GUINEE, compte tenu de la structure du réseau Internet ou GSM et des spécificités liées au Service MTN Mobile Money.

- MTN Mobile Money S.A pourra, à tout moment et sans préavis, suspendre le service MTN Mobile Money en cas de risque supposé ou avéré de la confidentialité du Service.

5.2 Cas fortuit et force majeure

- MTN Mobile Money S.A ne pourra être tenue pour responsable de tout cas fortuit ou de force majeure, rendant impossible l'exécution de ses obligations, soit partiellement, soit en totalité, dont elle n'aura pu, malgré ses diligences, empêcher la survenance.

- La force majeure, entendue dans les présentes, est celle habituellement qualifiée par les tribunaux tel à titre d'exemple le dysfonctionnement ou l'interruption totale ou partielle des réseaux de communication tel qu'Internet, GSM ou indépendant.

- Les cas de force majeure suspendront l'exécution des présentes Conditions Générales. En conséquence, le Service MTN MOBILE MONEY sera suspendu.

- Si la durée de la force majeure entraîne la suspension du Service MTN Money pendant une durée supérieure à trois (3) mois, les présentes Conditions Générales seront résiliées de plein droit, sans indemnisation aucune au profit du PORTEUR. Ce dernier pourra obtenir en revanche, le remboursement de la monnaie non utilisée conformément à l'article 12 du présent contrat.

ARTICLE 6 : REMBOURSEMENT

6.1. Conditions de remboursement

Pendant la période de validité de l'instrument de paiement électronique, le PORTEUR pourra demander le remboursement des unités de monnaie électronique non utilisées. La demande doit être faite par courrier écrit adressé à MTN Mobile Money S.A à l’adresse suivante :

MTN Mobile Money S.A., Almamya, Commune de Kaloum, B.P. 3237 Conakry Tel : 664222222

La demande de remboursement devra porter sur une somme supérieure ou égale Dix Mille (10 000) Francs Guinéens

6.2. Délai de remboursement

Le remboursement sera effectué sans frais et à la valeur nominale. Le PORTEUR devra se rendre pour se faire payer auprès de toutes les agences MTN Mobile Money, où il pourra percevoir les sommes qui lui reviennent.

ARTICLE 7 : RESPONSABILITES

7.1 Responsabilités du PORTEUR

- Le PORTEUR reconnaît être seul responsable des préjudices financiers qui pourraient être causés par l'utilisation abusive de son téléphone portable et de son code secret.

- Le PORTEUR reconnaît être seul responsable du préjudice monétaire subi en cas d'erreur commise par lui dans la transmission des coordonnées du Bénéficiaire du Transfert de fonds. Dans le cadre du Service Mobile Money, MTN Mobile Money S.A ne dispose d'aucun moyen pour vérifier que l'identité du Bénéficiaire désigné correspond à la personne à laquelle le Porteur souhaite transférer des fonds.

- Le PORTEUR est responsable de toutes les conséquences qui résulteraient d'une erreur de transmission ou de manipulation de sa part.

- Tout ordre de Transfert de fonds passé à partir du téléphone portable du PORTEUR, authentifié au moyen de son code secret, est réputé être effectué par lui sauf opposition formulée conformément à l'article 4 du présent contrat.

- Le PORTEUR supportera seul les éventuels préjudices résultant d'ordres de Transferts de fonds passés à partir de son code secret, lorsqu’ aucune opposition n'aura été enregistrée à la suite de la perte, au vol ou l'utilisation frauduleuse de la SIM et du Code secret support du portemonnaie électronique ou dont l'opposition téléphonique n'aura pas été confirmée par écrit. Il en sera de même lorsque l’opposition bien que formulée, est tardive à l’utilisation de la SIM ou du code secret au préjudice du PORTEUR.

7.2 Responsabilités de MTN Mobile Money S.A

- MTN Mobile Money S.A n'assume aucune responsabilité lorsque l'inexécution de ses obligations résulte d'un cas de force majeure, notamment en cas d'interruption du Service liée à des problèmes de transport des informations.

- MTN Mobile Money S.A n'est pas responsable des conséquences résultant d'un défaut de sécurité (matériel ou logiciel) de l'état du terminal de connexion (ordinateur, téléphone mobile) utilisé par le PORTEUR.

- MTN Mobile Money S.A n'est pas responsable des éventuels litiges, plaintes, contestations et autres différends qui pourraient survenir entre le PORTEUR et les bénéficiaires de ses transferts de fonds ou le PORTEUR et son opérateur de téléphonie mobile.

- MTN Mobile Money S.A ne sera tenue responsable que pour des pertes directes encourues par le PORTEUR dues au mauvais fonctionnement du système de paiement sur lequel elle a un contrôle direct. Toutefois, MTN Mobile Money S.A ne sera pas tenue responsable des pertes dues à une panne technique du système de paiement si celle-ci a été signalée au PORTEUR par un message sur son téléphone portable ou par tout autre moyen visible.

- La responsabilité de MTN Mobile Money S.A suite à l'exécution erronée d'une opération sera limitée au montant principal de la transaction. Cette responsabilité n’aura pas lieu lorsque le PORTEUR aura contribué de façon avérée de quelque manière que ce soit à la commission de la faute.

ARTICLE 8 : JUSTIFICATIFS DES TRANSACTIONS

- Les Parties conviennent que pour la validation des ordres de transfert de fonds, de retrait d'espèces ou de paiement de factures, des données et informations pourront être échangées à partir d'un support électronique ou d'un téléphone portable, et transiter par des réseaux de transmission électronique (courriers électroniques) ou de téléphonie mobile (SMS), sans avoir recours à l'utilisation du support papier.

- Les Parties acceptent de ne pas contester le contenu, la fiabilité, l'intégrité ou la valeur probante des données et informations contenues dans tout document électronique (notamment courrier électronique ou SMS) au seul motif que ce document est établi sur un support électronique et transmis par voie électronique ou par réseau de téléphonie mobile.

- Les Parties conviennent que les communications par lesquelles une transaction est dénouée constituent les preuves de la passation de ces ordres. A cet égard, MTN Mobile Money S.A procèdera à un archivage et à un enregistrement de toutes données et informations relatives aux transactions sur un support fiable dans un délai maximum de cinq (5 ans) à compter de la date de la transaction.

ARTICLE 9 : RÉCLAMATIONS

Le PORTEUR peut présenter des réclamations par appel téléphonique en appelant le service client au 111 pendant les horaires d'ouverture ou physiquement dans les agences MTN Mobile Money S.A.

La prise en charge de la réclamation faite au téléphone sera soumise à une procédure d'authentification du Porteur. Le Porteur n'ayant pas réussi cette authentification sera tenu de se rendre à une agence de MTN Mobile Money S.A. Les réclamations sur transactions ne seront prises en compte que lorsqu'elles sont faites dans un délai de deux (2) jours maximums, à compter de la date de l'opération contestée.

Toute réclamation justifiée, dans le délai ci-dessus, ouvre droit à régularisation dans les limites du montant de la transaction objet de la réclamation dans un délai qui ne puisse excéder trente (30) jours.

ARTICLE 10 : CONDITIONS FINANCIÈRES

Les conditions financières du service Mobile Money sont mentionnées dans la brochure tarifaire qui sera remise au PORTEUR à la signature du présent contrat ou affichées dans les locaux des agences ou banques partenaires y compris les agences et points de ventes AREEBA Guinée S.A et MTN Mobile Money S.A.

ARTICLE 11 : SANCTIONS

Tout usage abusif ou frauduleux du service Mobile Money expose le PORTEUR aux sanctions pénales prévues par la législation applicable en République de Guinée et entraîne la résiliation immédiate du contrat sans préavis ni réclamations.

ARTICLE 12 : MODIFICATIONS DU CONTRAT

- Il est expressément convenu entre le Porteur et MTN Mobile Money S.A, que celle-ci se réserve le droit de modifier à tout moment, pour des raisons notamment techniques, financières et/ou de sécurité, les conditions d'exécution du Service Mobile Money, y compris les modalités de réalisation des Transferts de fonds.

- il est attendu que toute modification dans l’exécution du service Mobile Money n’entrera en vigueur qu’après informations préalables du PORTEUR conformément à la règlementation en vigueur.

ARTICLE 13 : ENTREE EN VIGUEUR, DUREE

Le présent contrat et ses conditions Générales sont pour une durée indéterminée et ils entrent en vigueur à compter de leurs signatures par chaque partie.

ARTICLE 14 : RESILIATION

Le contrat peut être résilié soit du fait de MTN Mobile Money S.A soit du fait du PORTEUR.

Du fait de MTN Mobile Money S.A

Tout manquement par le PORTEUR à l’une des obligations mises à sa charge dans le cadre de l’exécution du présent contrat et conditions générales, entraînera la rupture immédiate et de plein droit du présent contrat.

Du fait du PORTEUR

Le Porteur en respectant un délai de préavis de Quatre Vingt Dix (90) jours minimums pourra mettre fin aux présentes par courriers adressé à MTN Mobile Money S.A.

La monnaie électronique non utilisée détenue par le PORTEUR fera l’objet d’un remboursement par MTN Mobile Money S.A, à sa valeur nominale, sans frais dans un délai maximum de Soixante Douze (72) heures. Ce remboursement ne sera accordé que pour les crédits supérieurs à Dix Mille (10 000) Francs Guinéens.

ARTICLE 15 : IMPOTS ET FRAIS

Les parties conviennent que tous impôts et taxes auxquels les transactions opérées dans le cadre du service Mobile Money seront appliqués conformément à la règlementation en vigueur

ARTICLE 16 : REGLEMENT DES LITIGES

La validité du présent contrat et toutes autres questions ou litiges relatifs à sa rédaction, à son interprétation, à son exécution ou à sa résiliation, seront régis par les lois en vigueur en République de Guinée.

Un traitement à l’amiable de tous différends découlant du présent contrat sera recherché par les Parties dans les trente (30) jours de leur survenance. Si les Parties ne parviennent pas à un règlement amiable dans ce délai, les différends seront tranchés définitivement suivant le règlement de la Chambre d’Arbitrage de Guinée (CAG), par trois arbitres nommés conformément à ce règlement.

Toutes les sentences rendues lient les Parties qui s’engagent à les exécuter de bonne foi ; elles sont supposées avoir renoncé au recours en annulation devant les juridictions étatiques et à tout recours auquel elles sont en droit de renoncer dans le pays où le tribunal arbitral a son siège.

MTN shall not be held responsible for any injury, loss, expense or damage of any kind whatsoever suffered or incurred by any person who accesses or uses this website (the User) as a result of the User accessing this website, utilising any service offered on this website or relying on any information contained on this website for any reason whatsoever including but not limited to any injury, loss or damage suffered as a result of:

1.1 errors or discrepancies in the information provided

1.2. any unauthorised access of this website by third parties

1.3. any breakdown or failure of any equipment or medium of access to this website.

2. MODIFICATION OF TERMS OF USE

MTN reserves the right, in its sole discretion, to amend (including without limitation, by the addition of new terms and conditions) these Terms of Use at any time and from time to time without notice to you. Any such amendments shall come into effect immediately and automatically. You undertake to review these Terms of Use regularly prior to use of this website for any such amendments.

3. DEFINITIONS

3.1. The following terms shall have the corresponding meanings assigned to them:

3.1.1. Intellectual Property means, collectively, the patents, copyrights (and moral rights), Trade Marks, designs, models, brands, names, tradenames, graphics, icons, hyperlinks, Know-How, trade secrets and any other type of intellectual property (whether registered or unregistered including applications for and rights to obtain or use same) which are owned by, licensed to, used and/or held (whether or not currently) by MTN on or in connection with this website.

3.1.2. Know-How means all the ideas, designs, documents, diagrams, information, devices, technical and scientific data, secret and other processes and methods used by MTN in connection with this website, as well as all available information regarding marketing and promotion of the products and services described in this website, as well as all and any modifications or improvements to any of them.

4. INTERPRETATION

4.1. Unless the context requires otherwise or it is expressly stated to the contrary, any words and phrases:

4.1.1. defined in these Terms of Use will bear the same meaning throughout these Terms of Use;

5. OTHER TERMS AND CONDITIONS

Certain products and/or services offered on this website may be subject to additional terms and conditions as indicated on that part of the website (see Product Terms and Conditions) and your use of those products and/or services will also be subject to those additional terms and conditions governing those relevant products and/or services. To the extent that those additional terms and conditions conflict with these Terms of Use, then those additional terms and conditions shall take precedence.

Chaque fois qu’ils seront utilisés dans le présent contrat ou en relation avec son exécution, les termes suivants auront le sens défini ci-après :

PORTEUR : Abonné au service MTN Mobile Money en vertu des présentes, et détenteur de la monnaie électronique pour son propre compte.

MTN : désigne la marque par laquelle est commercialisée les produits et services Mobile Money et AREEBA Guinée S.A.

Mobile Money ou MoMo : est le nom sous lequel est commercialisé les produits et services objet des présentes.

Marchand : Tout commerçant, personne physique ou morale, fournisseur de biens et services, agréé par MTN Mobile Money S.A et habilité à encaisser les dépôts et à effectuer les retraits des PORTEURS et/ou acceptant la monnaie électronique comme moyen de paiement.

Monnaie Electronique : la Valeur monétaire représentant la créance sur l'émetteur, qui est :

- stockée sur un support électronique y compris magnétique (téléphone portable ou carte Sim) ;

- émise contre remise de fond de valeur égale ;

- acceptée comme moyen de paiement par des entreprises autres que l'émetteur.

ARTICLE 2 : OBJET DU SERVICE MOBILE MONEY

Mobile Money est un service innovant permettant à l'échelle nationale, d'effectuer des transactions financières relativement simples à partir du téléphone mobile et d'Internet

Les fonctionnalités potentielles de Mobile Money sont :

- le transfert d'argent (de compte à compte, de compte à cash, de cash à cash) ;

- l'alimentation du compte Mobile Money du PORTEUR avec la monnaie électronique auprès des établissements distributeur de monnaie électronique et de toutes agences MTN Mobile Money S.A

- encaissement et retrait de monnaie en espèce auprès des établissements distributeurs de monnaie électronique et de toutes agences des banques partenaire de MTN Mobile Money S.A

- le paiement des factures,

- l'achat de minutes de communication.

ARTICLE 3 : CONDITIONS DE SOUSCRIPTION ET D'UTILISATION DU SERVICE MTN MOBILE MONEY S.A PAR LE PORTEUR

3.1 Conditions de souscription

- Pour bénéficier du service Mobile Money, il faut :

- Etre âgé de 18 ans révolus ;

- Etre abonné chez l'opérateur de téléphonie AREEBA-Guinée S.A,

- Avoir signé le formulaire de souscription à Mobile Money et y avoir joint un support d’identité valide

- Avoir signé les présentes conditions d'utilisation qui régissent les relations contractuelles entre MTN Mobile Money S.A et l'utilisateur du service

Des dérogations peuvent être accordées pour les mineurs justifiant de leur maturité et assistés par leurs parents.

3.2 Utilisation du service

3.2.1 Alimentation du porte-monnaie électronique

L'alimentation du portemonnaie électronique du PORTEUR se fait contre remise de monnaie en espèce auprès d'une agence de MTN Mobile Money S.A, de AREEBA Guinée S.A, d’un Marchand agrée par MTN Mobile Money S.A ou les banques partenaires de MTN Mobile Money S.A.

Le PORTEUR n'est donc pas tenu de disposer d'un compte bancaire pour pouvoir utiliser le service Mobile Money.

3.2.2 Transfert d'argent

De compte à compte

Il s'agit du transfert d'argent d'un utilisateur Mobile Money vers un autre utilisateur du même service, ou d’un autre service conformément à la règlementation en vigueur.

De compte à cash

Il s'agit du transfert d'argent d'un utilisateur Mobile Money vers un non utilisateur Mobile Money.

Le non abonné devra alors se rendre dans une agence de MTN Mobile Money S.A ou chez un Marchand agrée par ladite société.

3.2.3 L'encaissement d'argent

Le PORTEUR pourra à sa guise procéder à l'encaissement et au décaissement de la monnaie électronique qu'il détient en se rendant à une agence de MTN Mobile Money ou chez un Marchand agrée par ladite société

3.2.4 Le paiement de facture

Cette transaction permettra au PORTEUR de régler depuis son portable ou via Internet, ses consommations auprès des facturiers agréés.